Attention, Collateralized

How Wall Street’s oldest language—debt, collateral, and yield—is finally catching up to the oldest market force: attention

From Bowie Bonds to MrBeast, the next asset class isn’t physical. It’s cultural.

Welcome back to Attention Capital

If you’ve been reading along, you know the through-line: attention isn’t a side effect of culture; it’s the collateral that underwrites it.

Last time, we traced how Nintendo turned wonder into enterprise value and how attention itself became the most reliable form of capital. This week, we go a step further.

When audiences become communities, their attention becomes an asset.

The only question is when capital starts treating it like one.

What does a term sheet for attention look like—and who writes it first?

That’s where this story begins.

Executive Summary

Attention is no longer a marketing metric. It’s collateral: the underlying asset of culture, media, and technology.

What began as fan bases and follower counts has become measurable, monetizable, and soon, financeable. This piece explores how the tools that built Wall Street’s leverage machine — credit scoring, securitization, yield — are being reimagined for the Attention Economy, where audience behavior replaces cash flow as the foundation for value creation.

Quick Primer: Wall Street Terms in Plain English

Collateral: What backs the bet. The asset you lend against.

Leverage: Using borrowed money to magnify upside (and sometimes, risk).

Securitization: Packaging future income—like royalties or subscriptions—into tradable financial products.

Yield: The return you earn for taking risk.

Behavioral collateral: When trust, attention, or engagement—not factories—become the thing you underwrite.

(Skip if you speak fluent finance.)

I spent my first decade on Wall Street in places like Bear Stearns and Cahill Gordon & Reindel, watching capital move from risk to paper to product. The game was always about collateral. You didn’t make loans; you created instruments. You didn’t buy risk; you priced behavior.

That same logic now applies to the creator economy—only the collateral isn’t tangible anymore. It’s attention.

Attention behaves like capital. It flows, compounds, depreciates if neglected, and rewards whoever manages it best. It can be modeled, underwritten, and leveraged. Yet despite its market power, capital markets still treat attention as a marketing expense instead of an asset class. That’s the inefficiency.

The internet turned audiences into balance sheets. The next step is to start writing the term sheets.

If you can finance a film slate, you can finance a fandom.

1. Collateral, Then and Now

Before creators, there were corporations. Before influencers, there were issuers.

Wall Street learned long ago that value isn’t about what something is; it’s about what it does. Leveraged finance, securitization, and private credit all rest on one core principle: project future behavior and discount it back to today. Collateral was never just physical. It was behavioral.

That’s why cash-flow lending replaced asset-based lending as the backbone of leveraged finance. Lenders realized the true collateral was a company’s ability to generate predictable performance. The numbers bear it out: more than 90% of U.S. leveraged loans are now “covenant-lite,” meaning lenders lean on borrower performance and sponsor discipline rather than fixed asset tests. In other words, the market already prices behavior.

Media has proven this logic for decades. Subscriptions turned audience habit into recurring revenue. Netflix, with roughly 260 million paid members, reports steady ARPU growth in its investor letters—creating annuity-like revenue streams. Spotify, with over 600 million monthly users and 240 million paid subscribers, shows the same pattern. Both companies borrow on the predictability of human behavior.

Translate that to the broader attention economy. Attention—whether held by a creator, studio, network, or brand—behaves like working capital. It flows through content, commerce, and community in ways that can be forecast with surprising accuracy. If a portfolio of subscribers can secure billions in debt for a streamer, a portfolio of high-retention audience relationships can anchor credit for a creator-led business, studio, or cultural brand.

This isn’t a leap. It’s a translation. The same systems that value syndicated loans or IP-backed cash flows can now be applied to communities and engagement loops. You’re still underwriting behavior. You’re still buying time.

“Wall Street has always priced behavior. It just didn’t call it that.”

2. Media Was the Prototype

“Markets have always traded belief.”

Hollywood already proved the concept. So did music. The through-line: turn future attention into present capital, then scale.

Bowie Bonds (1997)

David Bowie worked with banker David Pullman and Prudential to raise $55 million against royalties from 25 pre-1990 albums. Investors bought a cash flow stream tied to audience demand. Napster dented CD sales and Moody’s later cut the rating, but the bonds still redeemed in full in 2007. The takeaway: IP cash flows can be packaged, priced, and paid back—even across format shocks.

Studio Slate Financing (2004–2015)

Instead of betting on a single film, Wall Street financed slates and priced the curve. Paramount’s Melrose funds pooled dozens of titles with outside capital; similar playbooks ran through Warner Bros., Sony, and Universal. Legendary’s early co-financing with Warner Bros. institutionalized the “shared risk, shared upside” model that fueled a decade of tentpoles. (See also RatPac-Dune’s $450 million slate with Warner Bros.

Marvel’s Character-Backed Credit Line (2005)

Marvel secured a $525 million revolving facility with Merrill Lynch to self-finance up to ten films. The collateral wasn’t factories. It was characters, distribution rights, and future film cash flows. That structure birthed the MCU as a financing engine before it was a cultural one.

Streaming Turns Users Into Underwriting (2017–2019)

Netflix issued multi-billion-dollar high-yield bonds to fund content backed by the logic that subscribers and hours watched would service the debt. As scale grew, the market learned to read engagement as coverage. Spotify’s direct listing disclosures taught investors to model retention, churn, and cohort behavior like credit metrics.

Music Royalties Become Yield Products (2020–2025)

Hipgnosis and Blackstone launched a $1 billion vehicle to acquire and manage songs as income assets. Kobalt packaged royalties into asset-backed securities. Concord followed with multi-hundred-million securitizations. What used to be “creative upside” now throws off coupon-like cash.

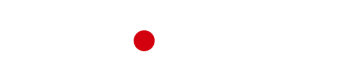

The Pattern That Repeats

Creativity draws attention. Attention produces revenue. Revenue becomes collateral. Collateral invites capital. Capital scales the system. We’ve been doing versions of this for thirty years. The attention economy is simply the next venue.

“Creative upside now throws off coupon-like cash.”

The blueprint was clear: media had already proven how to turn attention into an asset class.

The next question wasn’t if it could scale—it was who would try first.

3. The First Movers: What They Got Right—and What Comes Next

The first real attempts to finance creator attention came from firms like Jellysmack, Spotter, and Creative Juice. Each built pipelines to advance money against future YouTube revenue. Clever, but incomplete.

They treated creators like factoring clients, not businesses. The transactions were revenue pre-purchases, not credit facilities. The model created liquidity, not leverage.

In traditional finance, that’s the difference between selling your receivables and raising a revolver. One limits growth; the other fuels it.

Jellysmack: Scale Meets Fragility

Jellysmack raised a $500 million catalog licensing fund to buy YouTube back catalogs and monetize them across platforms. The pitch was simple: upfront cash for creators, recurring income for investors.

Then the yield curve broke. Platform distribution shifted, returns slipped, and the model’s debt-like exposure to Facebook and YouTube was exposed. The experiment still mattered. It proved creator income can be securitized, but it also showed how fast correlation risk moves in the attention market.

“Jellysmack proved you can securitize attention—just not someone else’s algorithm.”

By mid-2024, Jellysmack retrenched. Headcount fell by more than 25%, the focus moved from high-risk catalog licensing to white-label services, and the billion-dollar valuation cooled with the ad market. The lesson is straightforward: securitization is possible, but if you don’t control the rails, your model prices someone else’s risk.

Spotter: Liquidity Without Leverage

By 2024, Spotter had invested over $900 million across 700 channels, buying future ad revenue from creators like MrBeast and Dude Perfect. It was efficient, data-driven, and fast. The model worked in bull markets but didn’t build balance sheets. It created liquidity, not leverage; the YouTube equivalent of invoice financing.

As CPMs tightened, it diversified into brand partnerships and data analytics. The company proved demand for creator liquidity—but not yet creator debt capacity.

Creative Juice: The First Hint of Equity Thinking

Backed by MrBeast and initialized by investors who understood creator behavior, Creative Juice began with small “Juice Fund” advances and scaled to $50 million by 2022. Unlike its predecessors, it invested in growth. 70% of funded creators hired staff, 70% upgraded production, and most doubled their brand-deal rates within months.

It was the first glimpse of creator capital functioning as working capital. Money wasn’t just a payout; it was infrastructure. Creative Juice treated creators like early-stage companies with measurable risk and scalable upside.

After its initial fund, the company evolved rather than contracted, leaning into equity-based partnerships and building small-business tools for creators: banking, invoicing, analytics. It repositioned itself less as a lender and more as a financial platform, something closer to a “creator credit union.” The pivot proved the real opportunity wasn’t in buying revenue—it was in building infrastructure.

The Real Lesson

The first wave of creator finance proved what Wall Street already knew: behavioral data can be modeled, priced, and financed. Jellysmack showed that audiences yield. Spotter proved that viewership is consistent enough to structure advances. Creative Juice showed that capital compounds attention when used strategically.

But none built leverage—the flywheel that turns liquidity into value creation. They operated like factors, not lenders. Their collateral was the past, not the future. Algorithm shifts, platform fees, and lack of underwriting standards made long-term credit impossible.

The takeaway isn’t failure. It’s proof of concept. The next generation of creator finance will borrow from structured credit, not factoring. It will price community stability, build risk curves, and underwrite attention like enterprise value.

Together, these early models outlined the rough draft of creator finance.

What’s missing is the operating logic underneath—the working capital model that makes attention flow through a system like cash.

“Liquidity helps you breathe. Leverage helps you grow.”

4. Attention as Working Capital

Attention is to creators—and companies—what cash flow is to businesses: the lifeblood of operations.

Like any current asset, it needs to move. You invest it, compound it, reinvest it. The winners aren’t those who capture the most views—they’re those who redeploy attention across content, commerce, and community to keep the ecosystem alive. Data shows roughly 70% of creator income now comes from brand deals, with many layering in subscriptions and direct-commerce streams.

“The winners aren’t those who capture attention—they’re those who redeploy it.”

In that sense, attention behaves like working capital. It cycles between liquidity (engagement), receivables (brand deals, subscriptions), and reinvestment (new content, ventures). The global creator economy already exceeds $250 billion and growing fast.

But that figure captures only the surface — brand partnerships, sponsorships, advertising. Goldman Sachs projects the broader market could reach $480 billion by 2027 and over $1.1 trillion by 2034 as the model shifts from rented influence to owned enterprises. The Creator Economy is the cash-flow phase. The Attention Economy is the ownership phase, measured in brand creation, equity stakes, and product-market capture — from Feastables to Prime to Joyride.

That’s why treating attention as collateral makes sense. It’s not static. It’s an active resource that generates yield when managed intelligently. Supporting this shift, creators and studios are diversifying beyond ad splits—taking control of the monetization loop.

Taste and creativity drive that yield. Culture decides its durability. Ultimately, the strongest asset is built on trust and community.

But if attention is going to function as an asset class, we need a way to quantify it—something rigorous enough for bankers, yet intuitive enough for builders.

5. Modeling Attention: The AQS and Term Sheet

If we want to finance attention, we have to measure it. Here’s a working prototype—a first draft of a term sheet for the Attention Economy. It’s a practical framework to use, debate, and refine: a common language for creators, media operators, and capital.

Note: What follows is illustrative, not final. I’m making reasonable assumptions to model how this could work in practice. The examples are composites, not first-party data. The goal isn’t precision—it’s to show what standardization could look like.

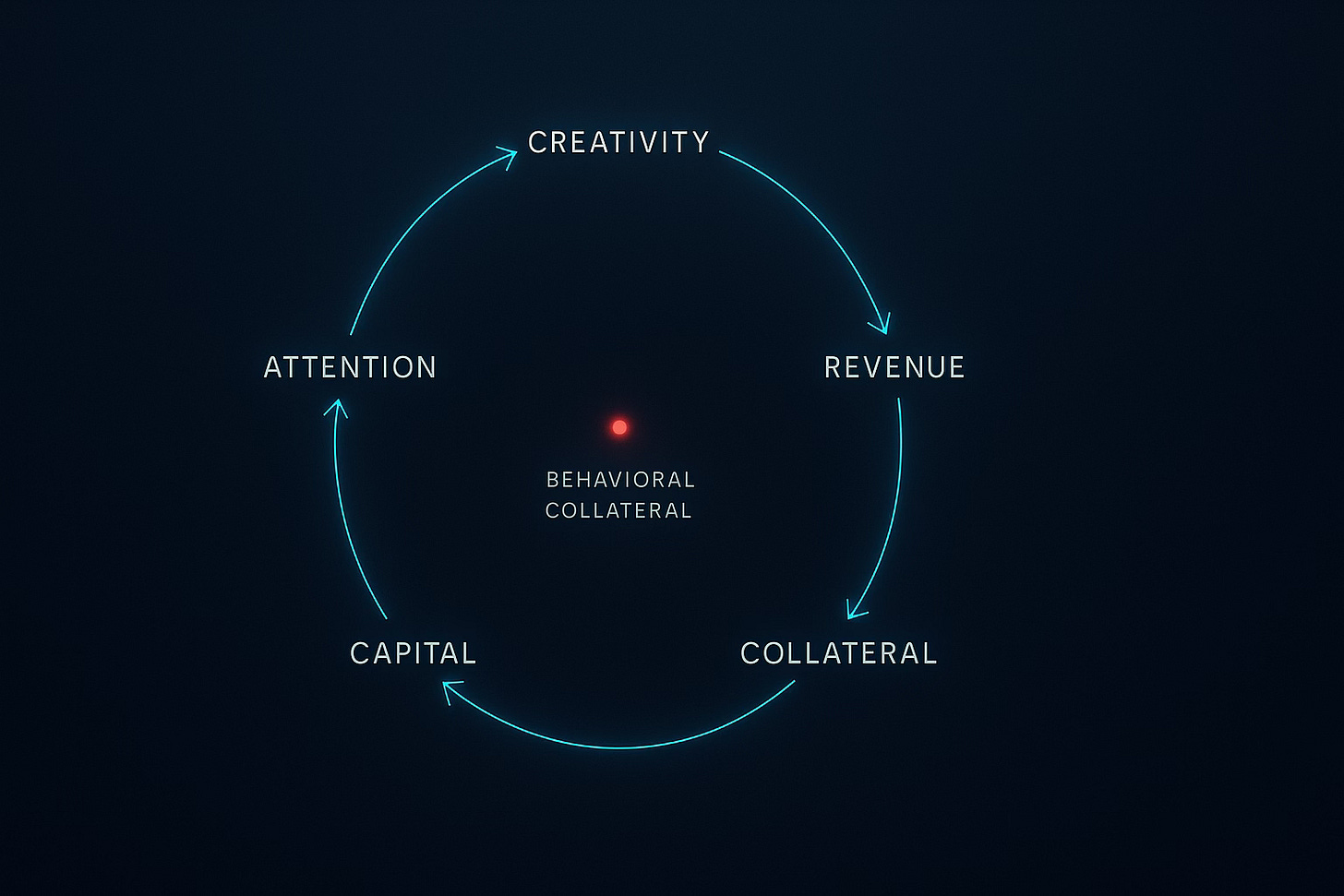

What AQS Is

The Attention Quality Score (AQS) is a 0–100 composite that measures how “bankable” an audience is. It focuses on behavior over hype and weights what compounds: stickiness, spend, and social gravity.

The Three Pillars (Core Weights)

1. Durability (35%)

How reliably the audience shows up over time.

Cohort retention: 28/90/365-day return rates

Session frequency per user

Audience decay (half-life of a post)

Percent of views from returning viewers

Share of traffic that’s pull (direct) vs push (algorithm)

2. Conversion Efficiency (35%)

How well attention turns into cash and owned relationships.

Revenue per 1,000 engaged users (not impressions)

Paid conversion rate (subs, members, tickets)

Off-platform click-through to owned channels

Commerce attach and repeat purchase rate

Share of revenue that’s direct vs platform-intermediated

3. Community Cohesion (30%)

How much the audience behaves like a community, not a crowd.

DAU/MAU in community surfaces (Discord, Patreon, newsletter)

UGC ratio (fan art, remixes, clips) to creator output

Comment quality signals and reply depth

Member density (paid or registered users per 1k followers)

Cross-platform overlap (how many follow you everywhere)

Two Modifiers (Risk and Moat)

1. Platform Risk (−10 to +10)

Penalizes single-platform dependence; rewards diversified reach and owned data.

2. Content Moat (−5 to +5)

Penalizes commodity trends; rewards distinctive IP, formats, or rights you own.

AQS = 0–100 after weights and modifiers, calculated on trailing 90 days with trend lines for 28 and 365.

How We Score It (Rules of the Road)

Normalize by category. A cooking channel and an esports league don’t pattern the same. Score within peer sets, then compare on a normalized basis.

Weight what repeats. Favor recurring behavior over one-off spikes.

Audit for authenticity. Bot filters, geography consistency, anomaly detection on watch-time and comments.

Publish the trend. Show level and slope. Flat at 85 is different than climbing from 72 to 78.

Ratings Bands (Plain-English Tiers)

Prime (85–100): Durable, diversified, cash-efficient. Investable at scale.

Core (70–84): Strong fundamentals with minor concentration risks.

Growth (55–69): Rising signals, needs proof on conversion or retention.

Volatile (40–54): Spiky traffic, weak repeat behavior.

Speculative (<40): Early or trend-dependent. Treat as options, not bonds.

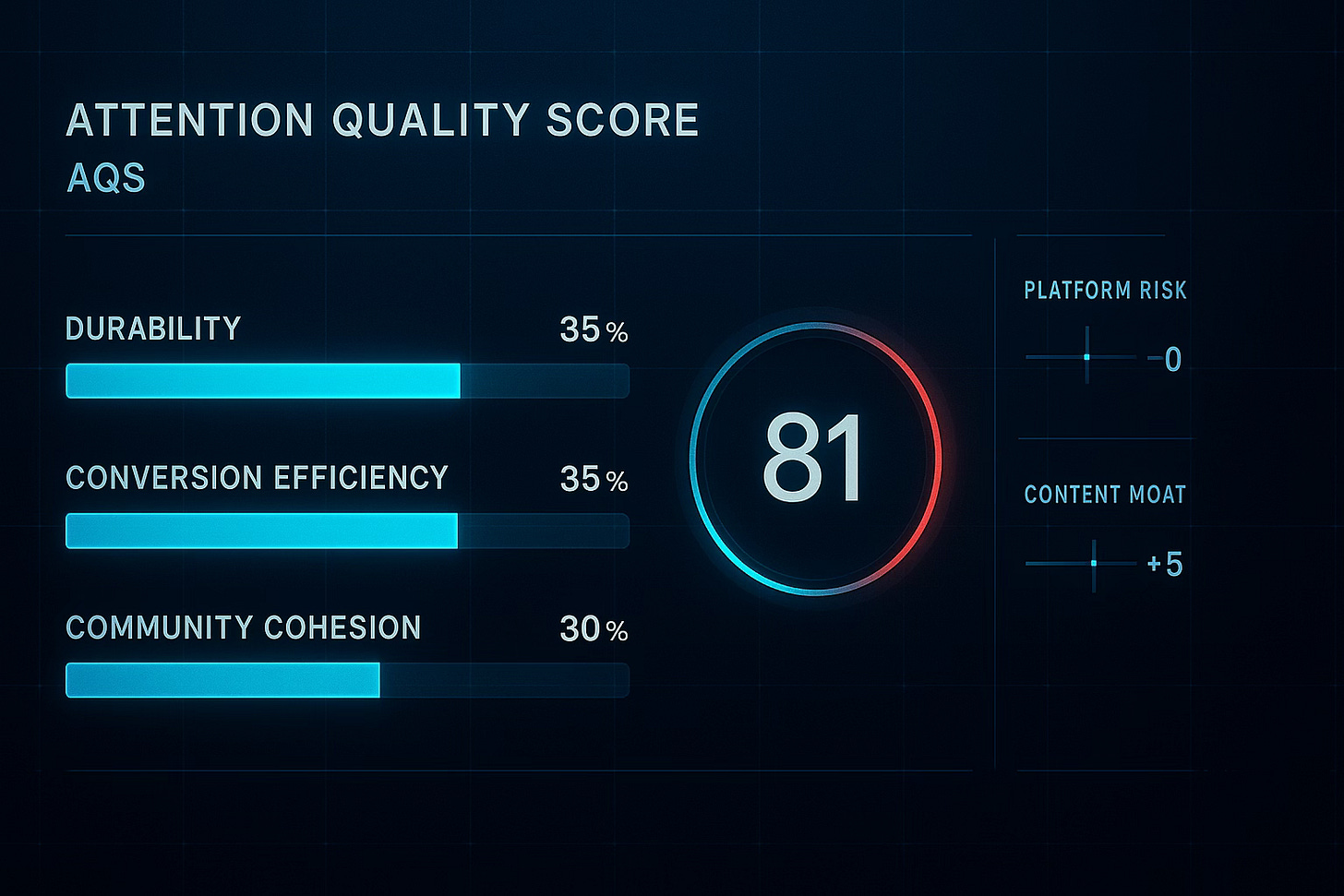

What counts as collateral (the “box”)

We’re not filing a long form here; we’re drawing the perimeter.

Entity-owned IP: trademarks, formats, catalogs, characters, domains

Contracted revenues: subs, memberships, licensing, minimum-guarantee deals

First-party lists: email/SMS with opt-in proof and delivery history

Inventory rights: ad slots, integrations, live events, merch pipelines

Data rights: aggregated, anonymized audience cohorts with usage rights

Advance rates and haircuts should key off AQS tier, diversification, and the direct vs platform revenue mix.

Illustrative Advance Ranges

Prime: 55–70% of forward 12-month net creator revenue (blended)

Core: 40–55%

Growth: 25–40%

Volatile/Speculative: structure as rev-share or options, not term debt

Triggers and Guardrails (Simple, Testable)

AQS floor: covenant if AQS drops >10 points or below band floor for two consecutive months

Mix shift: covenant if direct revenue share falls >15% from baseline

Platform shock: information rights and a plan if a single platform >50% of traffic changes payout or policy

Reserve covenant: minimum cash or undrawn revolver tied to payroll cycle for teams with headcount

Two Quick Examples

Example A: The Big Crowd

Lifestyle creator with 6 million followers, strong Shorts reach. Great impressions, low repeat behavior. Commerce CTR is thin, email list is small, most income is platform revenue and sporadic brand deals.

Durability: 58

Conversion: 46

Cohesion: 44

Platform risk: −6 (YouTube heavy)

Content moat: +2

AQS ≈ 49 (Volatile) → Treat with rev-share or project finance, not leverage.

Example B: The Focused Universe

Niche creator with 450k subs, 38k paid members, a newsletter with 31% open rate, and a DTC product that repeats at 3.1x yearly. Email and SMS lists are clean; revenues are majority direct.

Durability: 84

Conversion: 88

Cohesion: 86

Platform risk: +7 (diversified, owned data)

Content moat: +4

AQS ≈ 90 (Prime) → Eligible for term debt or larger advance against forward net revenue.

How This Becomes a Market

Standard Pack: everyone publishes the same four charts—AQS trend, revenue mix wheel, cohort retention, and conversion ladder.

Lightweight Attestation: quarterly third-party checks on bots, data lineage, and contracts.

Peer indices: roll up AQS scores across categories to build benchmarks and price risk.

Trade group: an LSTA-style body for docs, definitions, and disputes so we’re not reinventing the wheel in every deal.

Bottom Line: AQS isn’t about crowning celebrities. It’s about separating audiences you can count on from those you can’t—so creators raise smarter, operators plan better, and capital prices risk with real signals.

6. Lessons from Wall Street

In leveraged finance, collateral quality dictates cost of capital. The same will hold true here.

A creator—or company—with deep community retention and stable engagement will price capital cheaper than one with a volatile audience. It’s the same principle that drives spreads in the corporate loan market: predictability lowers risk, and risk dictates yield.

“Transparency, then trust, then liquidity.”

Once audience data becomes standardized and auditable, institutional money will step in. That’s how every asset class evolves: transparency, then trust, then liquidity.

We’ve seen this before. In the 1980s, leveraged loans became a global asset class once standardized covenants and credit ratings arrived. The the 1990s brought the same shift to mortgages. The pattern is repeating in IP and entertainment: music-royalty securitizations, film-slate financing, even NFT funds are early proofs of concept for attention-backed lending.

That’s where the Loan Syndications and Trading Association (LSTA) model becomes relevant. For decades, the LSTA has set the standards for leveraged loans—templates, covenants, pricing benchmarks, and trade settlements. It built the rulebook that turned private credit into a liquid institutional market.

Imagine a “Cultural Credit Association,” built on the same DNA:

Standardize documentation and collateral definitions.

Verify audience data and engagement metrics.

Create indices for cultural yield, AQS spreads, and performance cohorts.

Enable secondary liquidity for creator portfolios.

The result: less friction, more transparency, and institutional scale.

Attention will have its own credit market. And when it arrives, the participants will look familiar—credit funds, hedge funds, family offices—only this time, the collateral will be the most renewable resource on Earth: human attention.

7. The Credit Market for Culture

“Capital markets already know how to finance behavior. They just haven’t looked in the right direction.”

Picture a Bloomberg terminal tuned to culture. Instead of LIBOR or swap spreads, you’re tracking engagement velocity, retention yield, and cultural beta—the price signals of human attention.

That future isn’t far off. Every financial innovation follows the same path: price discovery, standardization, institutionalization. The attention economy is now entering the second phase.

The first entrants won’t be VCs chasing moonshots. They’ll be structured credit desks—teams that understand yield curves, hedging, and leverage. These funds will package creator portfolios and media IP the way Wall Street once bundled mortgages, catalogs, and film slates. Only now, the collateral lives in data.

When you can model attention with enough precision, you can finance it. You can securitize recurring engagement like streaming royalties or syndicate creator portfolios like loans. Capital markets know how to do this—they just haven’t been looking in the right direction.

The upside won’t come from owning creators. It’ll come from building the rails that finance them. The infrastructure, the scoring, the liquidity layer—that’s where value compounds. Culture is the next credit market.

8. Why It Matters

“A teenager in Tokyo can move more product than a Fortune 500 ad buy.”

Attention is the first truly global form of collateral.

It crosses borders faster than capital and converts into value without translation. It isn’t bound by currencies or contracts. It’s earned in moments, measured in engagement, and monetized across markets.

A teenager in Tokyo can move more product than a Fortune 500 ad buy. A creator in São Paulo can outdraw a network in Los Angeles. Influence has outpaced the institutions built to value it. That’s the opportunity.

The first phase of the attention economy was about capturing it—views, clicks, followers. The second will be about structuring it—turning engagement into assets that can be financed, traded, and scaled.

Whoever writes the term sheets for that market will define how culture gets capitalized—and, in the process, shape the next century of media and money.

9. Closing: The Story and the System

“Markets don’t wait for value—they define it.”

The same lessons that built Wall Street’s leverage machine apply here. You don’t finance creativity by controlling it. You finance it by structuring it.

The first time I watched a bond deal come together at Cahill, I learned that markets don’t wait for value—they define it. Value is what we agree to measure, model, and trade. Once consensus forms, everything else follows: the lawyers, the bankers, the investors, the markets.

We’re about to do that again. Only this time, the collateral isn’t factories, fleets, or paper. It’s the thing that underwrites every modern economy but still sits off-balance-sheet—our time, our attention, our trust.

Attention has already become the world’s scarcest resource. The next step is to recognize it as its most valuable one.

Once that happens, we won’t just be financing culture.

We’ll be structuring it.

Because that’s what every great market evolution does: it takes something ephemeral—energy, time, creativity—and gives it shape, standards, and scale. The industrial age did it with steel and oil. Wall Street did it with credit and risk. The digital age did it with data.

Now, the attention economy will do it with culture itself.

The institutions that recognize attention as collateral first will define the next era of capital formation. They’ll build the models, the markets, and the mechanisms that turn creativity into investable, repeatable enterprise value.

That’s the frontier—where finance meets feeling, and culture becomes capital.

Epilogue

We’ve spent decades quantifying everything except the thing that actually moves markets: what people care about.

Now, we finally can.

When behavior becomes data, and data becomes collateral, attention stops being a byproduct.

It becomes the balance sheet.

Why Subscribe?

Because attention is already being priced like infrastructure—and most people haven’t noticed yet.

From Tokyo to São Paulo to Wall Street, markets are learning to treat attention like yield. Every week, I break down the signals that prove it: billion-dollar creator deals, media valuations, and the structures turning fandoms into financial instruments.

If you work in finance, this is where you see where capital is really flowing.

If you work in media or tech, this is where you learn how to turn audience into equity.

If you’re a creator, it’s how you understand the market that’s starting to value what you actually produce.

Subscribe to Attention Capital to stay ahead of the shift—where attention stops being bought and starts being banked.

For more on attention as an asset class, visit attncap.com.